35+ How to determine borrowing capacity

Usually this can be calculated as follows. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus.

Presentation At The Capital One Southcoast Energy Conference

Whether youre a first home buyer refinancing your current home buying or investing in a new property we have a variety of tools and calculators to help you calculate your borrowing.

. Factors that contribute into the borrowing power calculation. Estimate how much you can borrow for your home loan using our borrowing power calculator. Work out your average living expenses and any debt you owe ie credit card and input it.

Capacity to repay debt. While there is a standard formula lenders follow lenders may assess your income or expenses. And not the gross income but.

Your credit report is one of the most significant factors determining your borrowing capacity. 35405638 Once you entered your values click on Calculate to get your Borrowing Capacity. Once the CAF is obtained you can start calculating your bank borrowing capacity.

Your credit score deposit sizes debts living expenses income lifestyle and other factors impact your borrowing capacity. Amount Home expenses Monthly Your Results You can buy a house of. As lenders offer different loan products theyll need you to look a the following factors before deciding your borrowing capacity.

You can improve your borrowing capacity by organising your. View your borrowing capacity and estimated home loan repayments. Cash flow indicates how much money you.

Your borrowing capacity is the maximum amount lenders will loan to you. Loan term and how long itll take you to meet full. The capacity to repay debt is the ability a company has to meet its financial obligations when they are due a business with a high capacity to repay.

Home loan providers analyze income to determine how much a person can afford to pay for a mortgage. Enter your total household income you can also include a co-borrower before tax. Lenders generally follow a basic formula to calculate your borrowing capacity.

Before making an investment or home loan decision on the basis of the information provided by the Maximum Borrowing Capacity Calculator you need to consider whether the information is. The first and most obvious factor is your income. Borrowing capacity Self-financing capacity 3 or.

But if you have a good handle then the money that you borrow will work perfectly according to your personal needs. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. In most cases income from.

Essentially the report details your relationship with credit your ability to repay debt and any. While we have made every effort to ensure the accuracy of the information appearing on this site it is for preliminary and general information only and is not to be relied upon as. Enter this information plus details of other income such as savings or government payments.

Think about your cash flow.

2

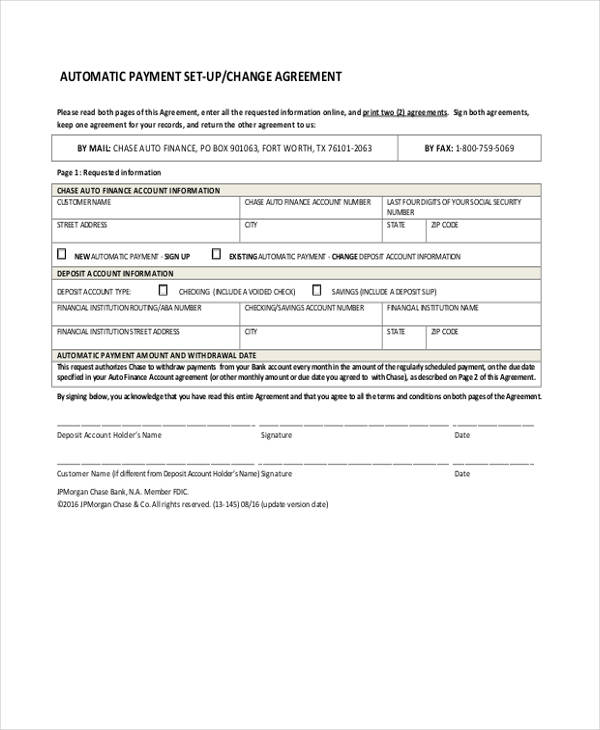

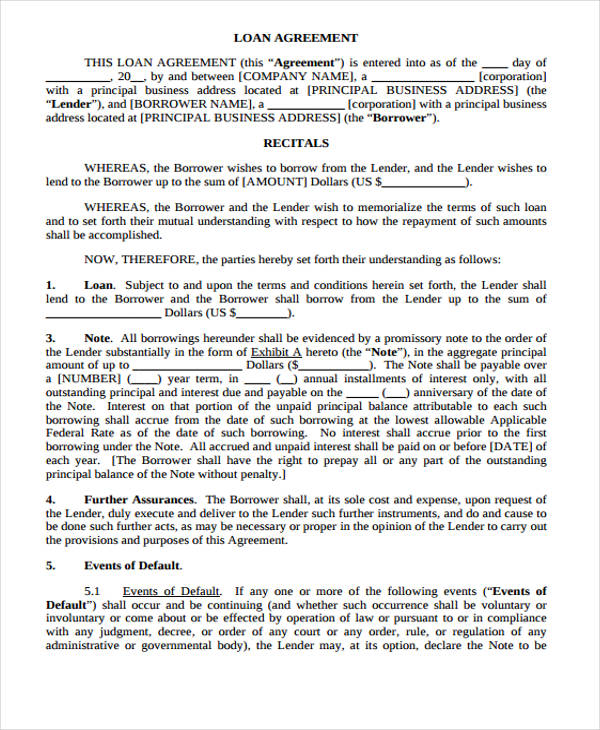

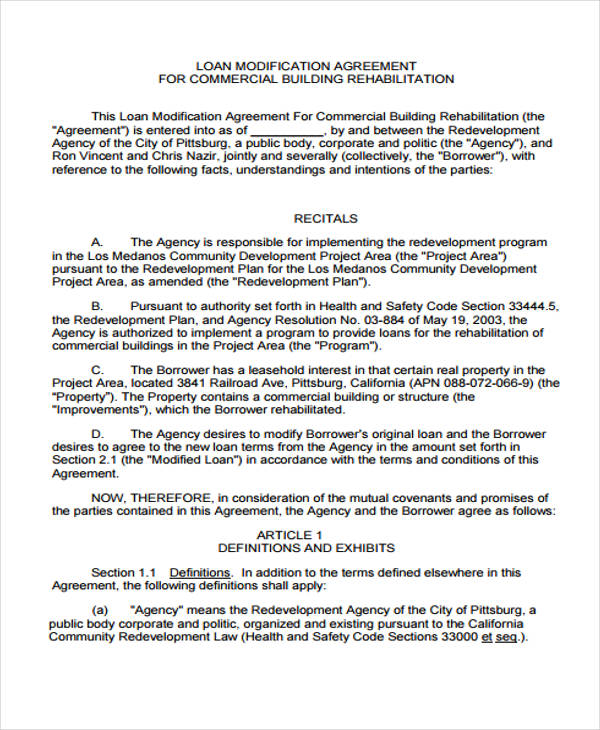

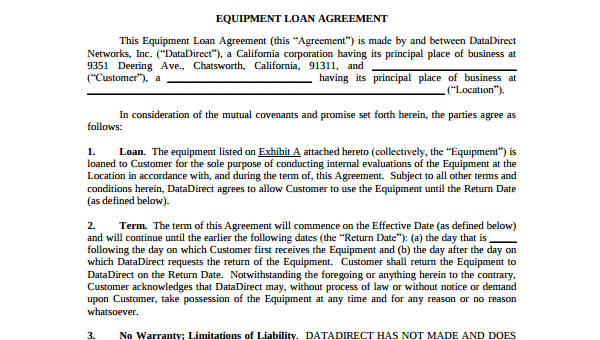

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 37 Loan Agreement Forms In Pdf Ms Word

2

2

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

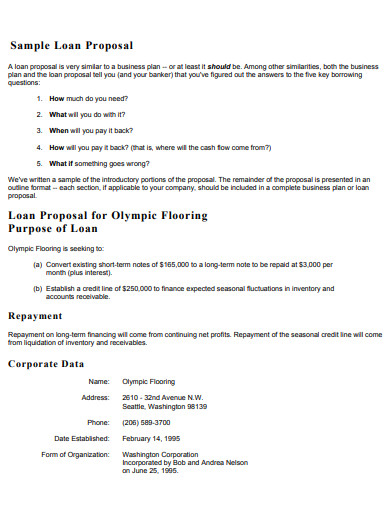

Free 6 Bank Loan Proposal Samples In Pdf

2

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

Update 8 1 Nashville Small Business Recovery Fund Pathway Lending

Free 40 Printable Loan Agreement Forms In Pdf Ms Word